We're thrilled to announce a record-breaking year for Kuflink, the award-winning financial lender you trust.

Tags: Blog, trending Blog

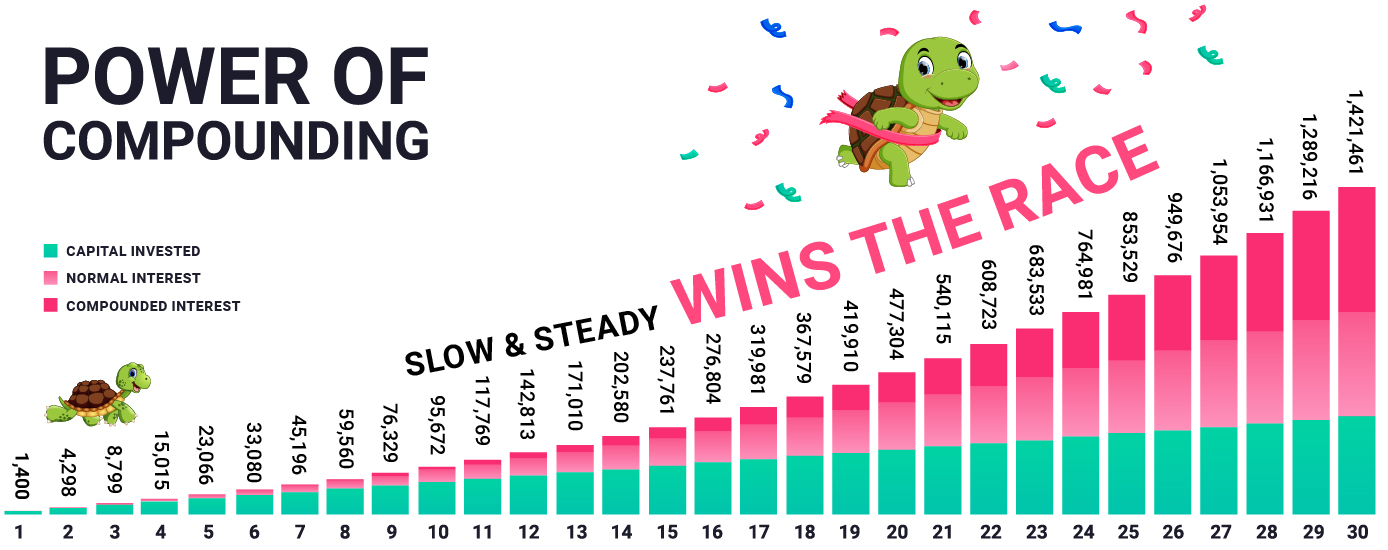

Earn £1m Interest Tax-free, using a simple UK Tax idea.*

Tags: Blog, IF-ISA, Peer to Peer,

As Head of Collections for Kuflink, and armed with 30 years of banking experience, I have taken to this department like a duck...

Tags: Blog, IF-ISA, Peer to Peer,

As we close out the year (2022) and welcome a new one (2023), we're delighted to share some of Kuflink's new features from our...

Tags: Blog, IF-ISA, Peer to Peer,

You can allow them to download an ebook, subscribe to your mailing list or book a meeting with sales in exchange for their contact information, turning them into leads for your business.

Kuflink Ltd is authorised and regulated by the Financial Conduct Authority (FCA) (Registration Number 724890). Kuflink Ltd has its registered office at 21 West Street, Gravesend, Kent, DA11 0BF, under company number 08460508. Kuflink Ltd has been approved by the Board of HM Revenue and Customs to act as an ISA manager in May 2017 to offer Innovative Finance ISAs - ISA manager No - Z1943.

Kuflink Bridging Ltd is authorised and regulated by the Financial Conduct Authority (FCA) (Registration Number 723495). Kuflink Bridging Ltd has its registered office at 21 West Street, Gravesend, Kent, DA11 0BF under company number 07889226.

Kuflink One Ltd is authorised and regulated by the Financial Conduct Authority (FCA) (Registration Number 922026). Kuflink One Ltd is registered in England at 21 West Street Gravesend, Kent DA110BF under company number 12206864.

© 2021 Kuflink Group Plc. All rights reserved. Kuflink ® is a registered European Community trademark (No. 1553541 & 1553358) and a registered United States trademark (No. 79295020 & 79295083) of Kuflink Group Plc.

*Capital is at risk and Kuflink is not protected by the FSCS. Past returns should not be used as a guide to future performance. Securing investments against UK property does not guarantee that your investments will be repaid and returns may be delayed. Tax rules apply to IF ISAs and SIPPs and may be subject to change. Kuflink does not offer any financial or tax advice in relation to the investment opportunities that it promotes. Please read our risk statement for full details.

© 2021 Kuflink Group Plc

Copyright © 2023 Kuflink Group Plc. All Rights Reserved.

Kuflink ® is a registered European Community trademark (No. 79295020 & 79295083) and a registered United States trademark (No. 1553541 & 1553358) of Kuflink Group Plc.

Kuflink Ltd (Incorporated in England & Wales: Co. No. 08460508) is authorised and regulated by the Financial Conduct Authority (FRN: 724890) as an Online P2P Platform. Kuflink Ltd has been approved by the Board of HM Revenue and Customs to act as an ISA manager in May 2017 to offer Innovative Finance ISAs - ISA manager No - Z1943. Kuflink Ltd has its registered office at Level 1, Devonshire House, One Mayfair Place, Mayfair, London, W1J 8AJ

.