IF-ISA, beginner's guide to earning £1m Interest Tax-free!

Earn £1m Interest Tax-free, using a simple UK Tax idea.*

ISA is an Individual Saving Account with TAX-FREE benefits on your earnings from this account.

There are four types of Individual Savings Accounts (ISA):

- Cash ISA;

- Stocks and shares ISA;

- Innovative Finance ISA (IF-ISA); and

- Lifetime ISA

You can put money into one of each kind of ISA each tax year.

You must be:

16 or over for a cash ISA

18 or over for stocks and shares or Innovative Finance ISA

18 or over but under 40 for a Lifetime ISA

You must also be either:

• resident in the UK

• a Crown servant (for example, diplomatic or overseas civil service) or their spouse or civil partner if you do not live in the UK

You cannot hold an ISA with or on behalf of someone else.

An innovative finance ISA lets you use your tax-free ISA allowance while investing in peer-to-peer (P2P) lending.

Peer-to-peer lending is a form of investing where you directly lend money to borrowers and businesses. The borrowers then pay back the borrowed amount, with interest on top. The interest they pay is the return you get on your investment. You earn this interest tax-free.

Investors (IF-ISA holders) are linked with borrowers. A borrower could be a business, an individual or a property developer.

So, with an Innovative Finance ISA, your IF-ISA account contains P2P loans. With a cash ISA, it has cash, and with stocks and shares, it includes stocks and shares.

1. IF-ISA Allowance 2023/2024 - £20,000 - Expires on 5th April 2024: 23:59 - You lose any unused allowance and the opportunity to earn tax-free interest on this amount- 🐢

2. IF-ISA Allowance 2024/2024 - £20,000 - Starts on 6th April 2023: 00:00 - 🐢

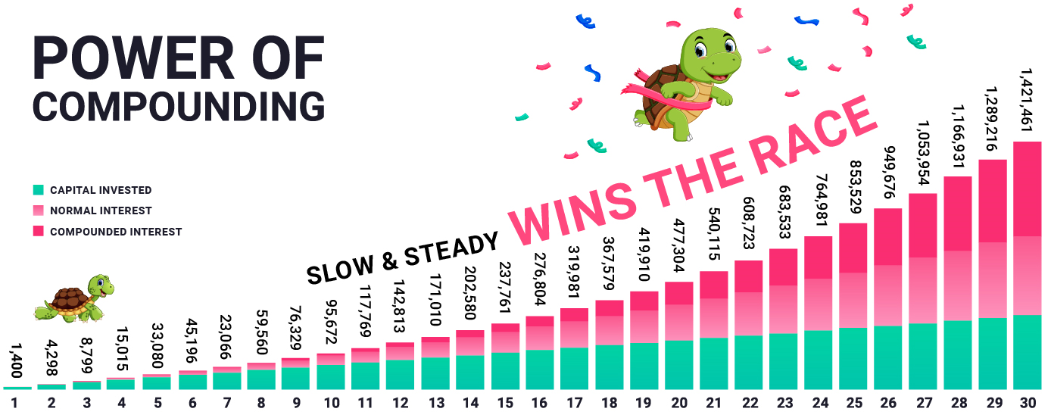

We would like to share the following model to show you how to earn over £1m in Interest, Tax-free.

Our Accountants, Compliance and Tech teams brainstormed in the boardroom and discovered a way to make over £1m net Tax-free interest using the Kuflink IF-ISA model*. Being tax-free boosts your returns, and by compounding the tax-free earnings, you can watch your money grow even more over time. Kuflink's IF-ISA fits this model.

Consider the following to earn £1M TAX-FREE from Kuflink's 5-Year IF-ISA at 8.05% *†. (The concept works on smaller amounts as the percentage return is the same).

Kuflink Innovative Finance ISA (IF-ISA)

- Pays up to 8.05%*† - Tax-free

- Transfer a current Cash ISA, Stock & Shares ISA, Lifetime ISA or IF-ISA.*

- Use your £20,000 annual tax-free allowance with Kuflink's IF-ISA*

- Get started today with just £100

-

Diversify funds across multiple secured loans.

- Entire Pool secured against UK Property* (1st & 2nd legal charges)

- Blended LTV & LTGDV (circa 65%)

- Over £15m in ISA Transfers into Kuflink from Major ISA Providers

* Don’t invest unless you’re prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Take 2 mins to learn more.

†Gross annual interest equivalent rate (compounded annually) - FAQ

Kuflink Ltd is authorised and regulated by the Financial Conduct Authority (FCA) (Registration Number 724890). Kuflink Ltd has its registered office at 21 West Street, Gravesend, Kent, DA11 0BF, under company number 08460508. Kuflink Ltd has been approved by the Board of HM Revenue and Customs to act as an ISA manager in May 2017 to offer Innovative Finance ISAs – ISA manager No – Z1943.

Our Awards

.png)